Photovoltaic glass or will drive a wave of soda ash market

Commodities have started a more differentiated trend since July, and the epidemic has also restrained the rising pace of many varieties, but soda ash has been slow to follow.

There are several levels in front of soda ash:

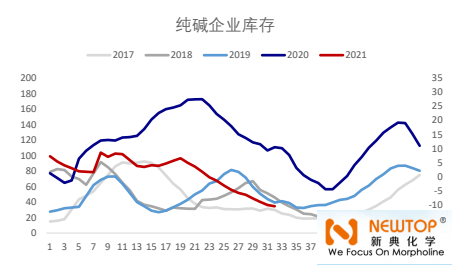

1. The manufacturer’s inventory is very low, but the hidden inventory of the glass factory is high;

2, solar energy production capacity expansion, but not now;

3. The new contract meets expectations and is too overdraft.

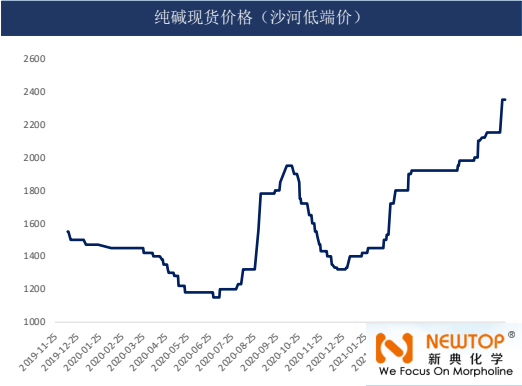

In early August, the spot price increased by about 200 yuan. At present, the lowest spot delivery price is 2350 yuan/ton (delivered at Jinshan insured price), and some high-priced areas are 2400-2500 yuan/ton. There is still fear of heights and cautious transactions in the downstream, soda factories have sufficient orders and cargo transportation is smooth.

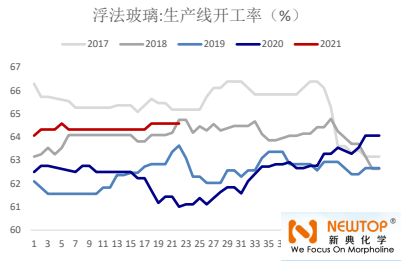

As of Thursday, the domestic float glass production lines remained unchanged, with a total of 306 lines and 265 lines in production, with a daily melting capacity of 175,325 tons, the same as last week.

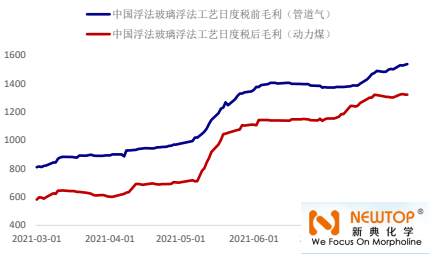

The average profit of the float glass industry was 1425.89 yuan/ton, a slight increase of 12.86 yuan/ton from the previous month. The comprehensive industry profit during the week increased by 0.91% from the previous month.

Glass is the direct downstream of soda ash, and the good demand of glass has a direct driving effect on soda ash. However, the glass factory has accumulated a large amount of soda ash inventory, leading to a phased contradiction between supply and demand in advance.

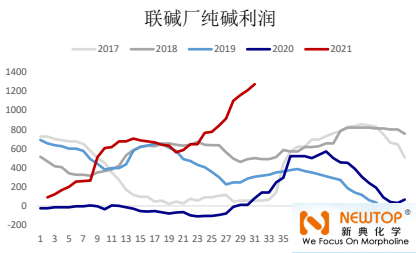

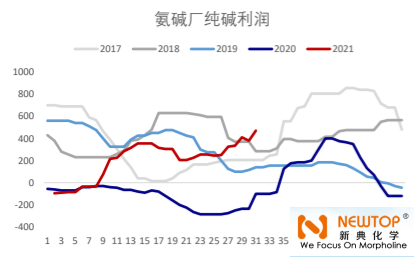

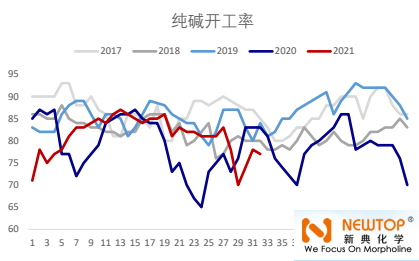

This week, the weighted average operating load of soda ash manufacturers was 77.4%, a slight decrease from last week; the profit was high, and the double-ton profit of Hou Soda manufacturers increased to about 1100-1200 yuan.

This week, the inventory of soda ash manufacturers was about 340,000 to 350,000 tons, a decrease of 4.2% month-on-month and 68.7% year-on-year. The accumulated inventory fell for the thirteenth week.

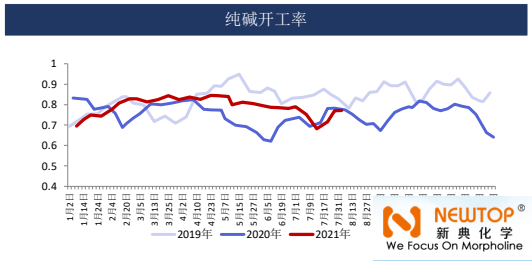

The overall operating rate of soda ash during the week was 77.14%, compared with 77.04% last week, an increase of 0.1% month-on-month. The co-production operating rate was 74.57%, down 3.73% from the previous month. The operating rate of ammonia base was 79.15%, up 4.27% from the previous month.

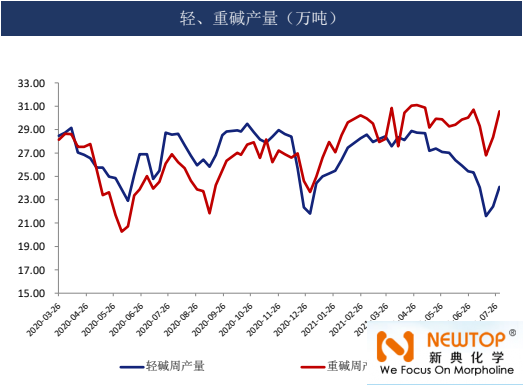

The output of soda ash during the week was 547,300 tons, an increase of 0.11%. The output of light alkali was 248 thousand tons, an increase of 7 thousand tons from the previous month. The output of heavy soda was 299,300 tons, a month-on-month decrease of 6,300 tons.

Heavy alkali is mainly used in glass production. One ton of glass requires 0.2 tons of heavy alkali. Light alkali is mainly used in the production of some daily chemical products. The soda ash in the futures is heavy soda, why should we pay attention to both? Because light alkali is the upstream of heavy alkali, if the price of heavy alkali rises, light alkali producers will turn to produce heavy alkali because of the temptation of profit, which will increase the supply of heavy alkali and pave the way for the price increase of light alkali.

At present, it can be seen that due to the stable daily chemical demand, the output of light alkali fluctuates regularly, but due to the good demand for glass, the output of heavy alkali remains high, which also verifies the contradiction between the supply and demand of heavy alkali.

July glass soda ash survey opinions:

1. In the past, the stock time of soda ash in the glass factory was one month, but recently it was from February to March. On the one hand, it is to prevent the price from rising rapidly, and on the other hand, it is also for the needs of safe and smooth production. Most manufacturers are optimistic about the long-term price of soda ash;

2. The building-integrated photovoltaic industry is currently only a pilot. Once the demand for soda ash increases, the attitude of manufacturers to store more soda ash can also explain this. Compared with glass, they are more optimistic about the medium and long-term demand for soda ash;

3. Soda ash supply side is unlikely to be out of stock in the short term. A delivery warehouse has large quantities of soda ash, which corresponds to the 2109 contract, and gradually increases the volume near the delivery, and the supply is sufficient;

4. Overall: the supply of soda ash is generally stable at a relatively high level, and the demand side is mainly based on two aspects: one is construction and real estate, which may be expected to concentrate the demand for glass, and the other is that under the background of “dual carbon”, photovoltaic The development potential of the clean energy industry is huge. Once the building-integrated photovoltaic industry is widely promoted, the demand for soda ash will be great. The demand is expected to be good, and the medium and long-term soda ash may continue to be optimistic.